I have been following Tornado Cash for a long time, both the project itself and its token. There is no doubt that Tornado Cash is a groundbreaking project that has achieved a great deal and the team and community members are working on the future of Tornado Cash. However, the recent negative market has made me think about the economic model of Tornado Cash.

As we all know, the basic condition for the normal operation of Tornado Cash is that there is sufficient capital in the pool. In other words, the greater the number of tokens in the pool and the wider the source, the better the privacy will be, it will be more widely accepted for the user who really need tornado cash, not short-term speculator. However, the number of users who are in need is only a small minority and most of those who use Tornado Cash are speculators in the market. This brings about a problem: the funds in the pool will be affected by the price of torn. If the price keeps falling in the future, the funds in the pool will flee in large numbers. Some people may argue with me, but the following statistics prove my point.

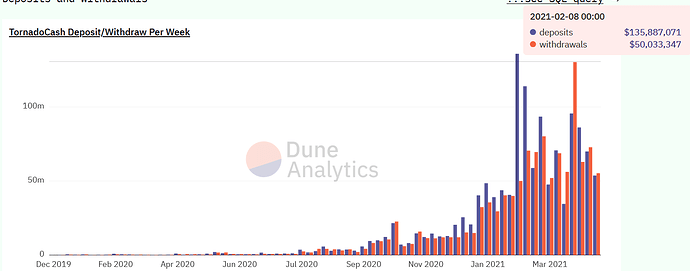

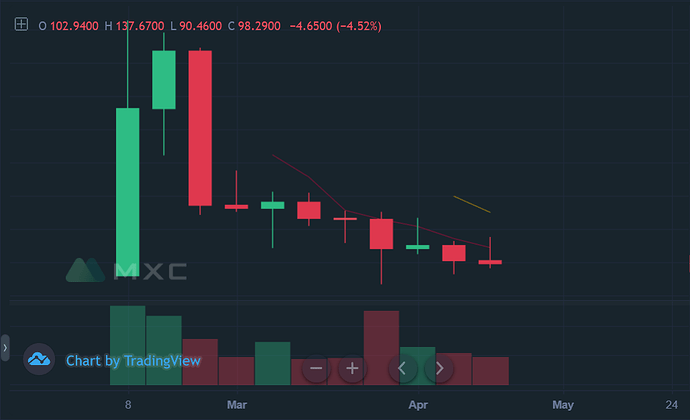

Figure 1 shows the changes of deposit and withdraw from the pool on a weekly basis. Figure 2 shows the weekly price fluctuation of Torn. As shown in the figure, the price of Torn was 80U when it was put on the cover, which quickly rose to about 450U a week later. At the same time, a large amount of funds poured into the pool, which greatly improved the safety of Tornado Cash. However, with the rapid decline of the price of Torn, the growth rate of deposits decreased sharply, and even the net outflow of funds in the pool began. It can be seen that even if the current price of Torn is stable at about 100U, the fund of the mixed currency pool is still flowing out. These data show that the price of Torn will have a substantial impact on the funds in the pool.

Figure1

Figure2

At present, the funds in the pool are still stable. Even if some funds start to be not optimistic about the future of the price of Torn. However, when the price continues to fall, will the funds again flee in large numbers. Moreover, it is TVL that speculators are bullish on Tornado Cash that continues to buy Torn. When the growth rate of TVL drops or even stops growing, it may lead to the collapse of Torn and further promote the withdrawal of a large number of funds from the pool. Pessimistically, this is a negative feedback that will destroy Tornado Cash when Torn prices fall. In the longer term, will there be enough capital to keep Tornado Cash going in a bear market? Moreover, after the 10%torn is fully distributed one year later, the incentive for speculators to deposit their funds in Tornado Cash may be greatly reduced. These issues are key to Tornado Cash. I think it’s worth thinking about.