Abstract

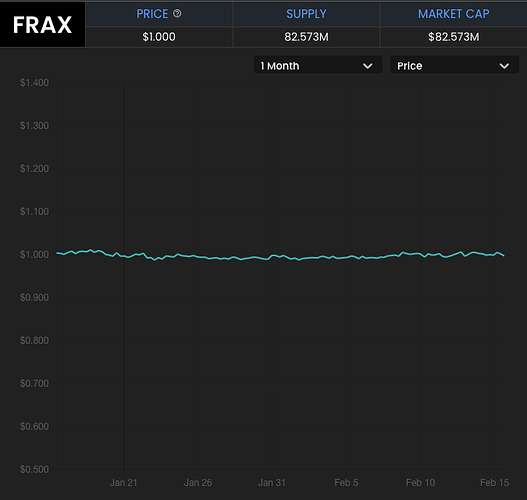

Stablecoins are one of the largest categories in both market share and opportunity in crypto. USDT currently sits #3 in market cap with nearly $40 billion and growing with USDC and DAI catching up. As users look for a stable unit of account and medium of exchange to transact, many will also prioritize an uncensorable stablecoin that allows users to transact their stablecoins in privacy. Already stablecoins such as USDT and USDC are listed on Tornado Cash yet there will always be an inherent risk that they will be forced to blacklist the protocol’s smart contracts. We propose adding FRAX, the first fractional-algorithmic stablecoin protocol. FRAX is currently the only algorithmic stablecoin which has kept a very tight peg (see below). As the founder, I can also commit to having our project build a “Frax Tornado Mint” feature within the Frax protocol so that minted FRAX stablecoins are directly minted into the Tornado anonymity set. This would exponentially expand the anonymity guarantees of FRAX and make Tornado our premier anonymity partner.

FRAX 30d price. Source: app.frax.finance

Proposal

- Add FRAX to the list of supported tokens that users can choose to deposit on Tornado Cash.

- Add 1000 FRAX and 100000 FRAX deposits as starting points. No other deposit size should be added if this proposal is accepted. These 2 deposit amounts should capture the entire market of FRAX from small payments to large movement of funds without fracturing anonymity sets into smaller deposit sizes. More could be added later if demand justifies.

- The Frax Protocol core team (including myself) will commit to building a “Frax Tornado Minter” function into the protocol level which would allow a user to mint FRAX which is immediately deposited into Tornado, the note passed to the user on the front end, and the FRAX withdrawable at a later time. This would mean that FRAX expansions can directly fuse into Tornado anonymity sets, helping expand the privacy guarantees of FRAX and also growing Tornado’s volume proportionally to FRAX’s expansion. We currently have over 80m FRAX in circulation with 500,000 to 1m FRAX minted per day during growth phases.

Background

FRAX is the first partially-collateralized stablecoin implementation on Ethereum which aims to provide a highly scalable, decentralized, algorithmic currency. The FRAX protocol is based on 2 tokens: FRAX as a stablecoin and FXS as a seigniorage-governance token. FRAX is backed by collateral in proportion to Collateral Ratio (CR). When the price of FRAX is above $1 the CR decreases and when FRAX is below $1 vice versa which leads to a market set collateral ratio that is as capital efficient as possible. FRAX is always mintable or redeemable for $1 equivalent. For more technical breadth, please see docs.frax.finance.

Since its inception, the FRAX model has proven to be resilient and has always maintained its peg of $1. What makes FRAX unique compared to other stablecoin models is that it is robust enough to expand and contract with demand, keep a tight peg, and the first protocol to not be fully collateralized while doing so. This is opposed to USDT & USDC which is vulnerable to custodial risk and DAI which is dependent on the over-collateralization of assets.

Benefits

- Allows users to execute transactions of a successfully working algorithmic stablecoin that is based on a fractional-algorithmic model

- Unlike USDT or USDC, there is no central authority that can directly censor FRAX transactions or blacklist contracts.

- FRAX team is a highly pro-cypherpunk, veteran team that has deep beliefs about privacy and anonymity and is looking for a highly technical privacy-solution project like Tornado to collaborate with.

- FRAX team is willing to build a “FRAX Tornado Minter” into the protocol to mix expansions of FRAX directly into the anonymity set.

- Expose Tornado Cash to a new community of users who otherwise would not have used the protocol

- FRAX community has expressed interest in incentivizing Tornado deposits with their FXS governance token. After implementation of the Frax Tornado Mint feature, it would be an elegant privacy preserving solution to incentivize using the Tornado minter with FXS tokens. The minting user would remain private while also being rewarded for adding to the anonymity set.

- First step in establishing a relationship between FRAX and TORN, paving the way for future collaborative activities that have yet to be conceived of

Thanks to Tornado & Frax community member Dave Liebowitz (https://twitter.com/davesaidthat_) for help preparing this proposal.

Specifications

- Website: https://frax.finance/

- Dashboard: https://app.frax.finance/

- Docs: https://docs.frax.finance/

- Staking and Lock-up data: Frax Finance

- Contract address: 0x853d955aCEf822Db058eb8505911ED77F175b99e

- Github: GitHub - FraxFinance/frax-solidity: Solidity implementation of the Frax Protocol

Further Reading

End of the Chain- FRAX Will Eat The Stablecoin World

defiprime- Interview with FRAX founder, Same Kazemian

CoinMonks- FRAX, a Partially-Collaterallized Stablecoin

Thread from the Founder of CoinGecko, Bobby Ong

Thread from Dave Liebowitz about the origin story of FRAX